what is an open end equity lease

In a Nutshell. A closed-end lease is a rental agreement that puts no obligation on the lessee the person making periodic lease payments to purchase the leased asset at the end of the.

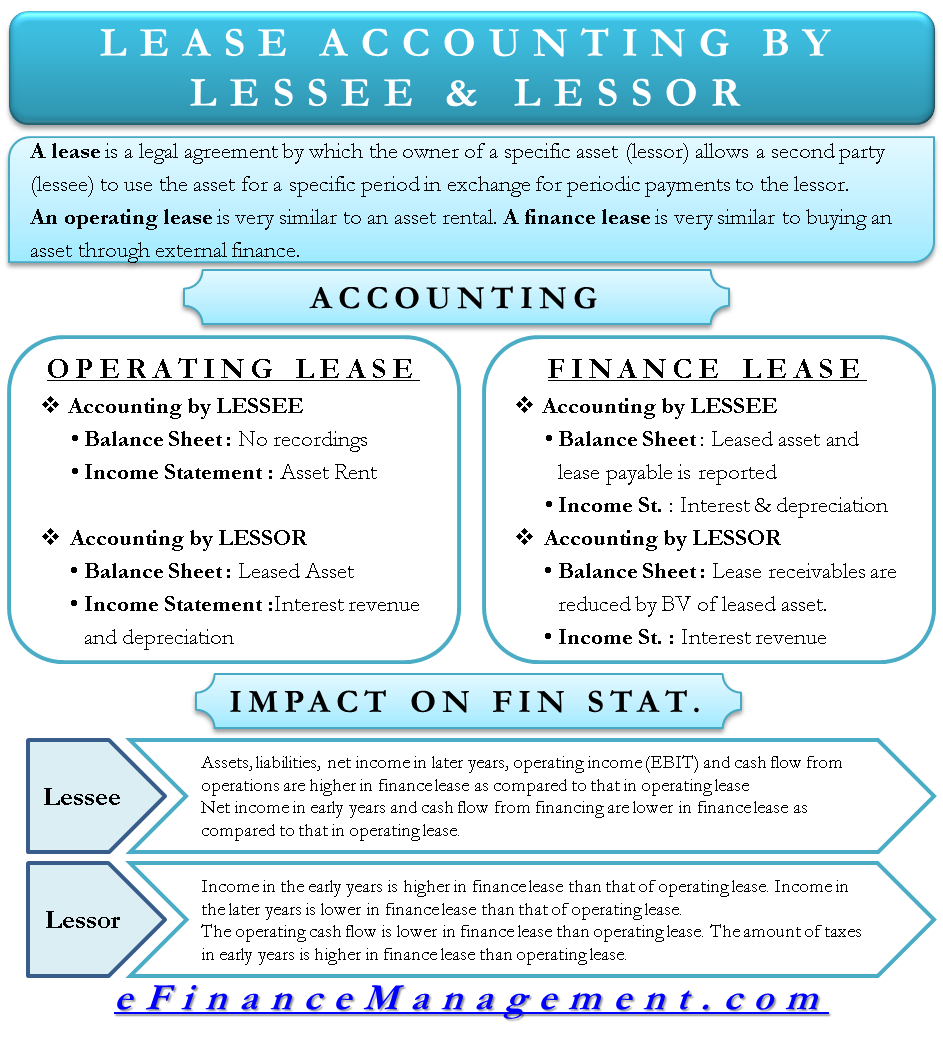

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

The lease contract usually a car or means of transport in which payable payments completely debt.

. In exchange for a monthly payment and a few fees as well as a down payment maybe you drive off with a new car. The structure of an open-end lease includes a minimum term typically 12 months. An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing.

For example if your lease early termination payoff is 16000 and the amount credited for the vehicle is 14000 your early termination charge will be 16000 minus 14000 or 2000. When you lease a car you dont own it unless you buy it at the end of the term. The costs related to the excess mileages and excessive damages will.

Depending on your vehicles mileage condition and other factors you could be sitting on hundreds if not thousands of dollars in lease equity. Open-end leases have flexible structures that are as close to vehicle ownership as possible only with the additional benefits of leasing. Financing Options for Open End Leasing Agreements.

When you do you turn in the vehicle for resale and. The total lease costs are calculated at the end of the lease term and the vehicle s under the lease are sold. What is an open-end lease.

This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages. If youre nearing the end of your lease dont simply return the car. What is an open ended equity lease.

An open-end lease is when you take on the vehicles depreciation risk. The lessee has the option of purchasing selling or trading-in the leased vehicle at the end of the contract for the. When you lease a car youll usually be offered a closed-end lease.

Aside from the ever-important method of writing off additional cost liability that could possibly be incurred from an open end lease in the case that the equipment depreciates significantly during the leasing term on your businesss taxes another important financing element of open end leasing is the. The employer takes all the financial risk. Closed End 36 months55000 miles07 per mile beyond 55000 miles.

In the closed-end lease you usually never know what the rate is charged to the lessor or what method of funding is used by the lessors funding source. An open-end lease containing a 12-month term that then goes month-to-month would require 12 months of payments on the balance sheet. A closed-end lease that is typically written for a contractual term of two to three years would require a larger amount on the balance sheet assuming the fleet does not believe there is an obligation to take on.

Monthly payments are usually lower than the grant of hired purchase the purchase lease requires large payments when maturing. This works well for employers since the cost of the vehicles can be written-off or. The terms include a minimum 12-month lease technically 367 days followed by a month-to-month structure.

You can terminate the lease at any point after the term ends. Lease equity is when your car is worth more at the end of the lease than the buyout that was established when the lease began. There are no mileage restrictions or penalties and the vehicle s can be returned at any.

Understanding Lease Equity. The open-end finance lease allows this flexibility while the closed-end lease does not. Because a leased vehicles actual cash value doesnt equal the residual value until the end of a lease term having a leased car with equity is quite rare.

A companyemployer will assume management and leasing of the car to its employees not the leasing company. Leasing is straightforward. There almost always are.

This payment scale is public when the lease terminates. Your total cost of ownership isnt known until the vehicle is remarketed. In this age of financial sophistication numerous indices are available to set interest rates.

But what is lease equity and more importantly how do you calculate the amount of equity in your leased car. It may also be referred to as a capital lease operating lease or TRAC lease With this type of lease your business has the option to retain equity in the vehicle while freeing up capital. In an open-end lease you may receive a refund of any gain and you are responsible for any deficiency.

When you choose a type of lease it is always preferable as a consumer to go for the closed-end lease in order to avoid surprising high costs at the end. Open-end leases also exist and are most often used in the case of commercial business lending. There are benefits attached to leasing including tax deductibles getting hardware replaced if it breaks down and getting potential upgrades at the end or.

An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing. What is an open ended equity lease. In an open-end lease more common in business leasing the person or company leasing the vehicle takes on that risk but leasing terms may be more flexible.

A new-car lease is a relatively short-term agreement. It is very rare that the mileage end up being too high at the end of the term unless it is for commercial purposes. What is an open-end lease.

However it is possible in some cases and we can explain how this can happen. In contrast to a closed lease contract. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

Youre given a contract with set specifications but the basics involve you paying a flat monthly rate in exchange for use of the equipment loaned to you. You can terminate the lease at any point after the term ends. It is very rare that the mileage end up being too high at the end of the term unless it is for commercial purposes.

The open-end TRAC lease has been a staple in the fleet industry for decades. Open-ended leases allow landlords and tenants to change the conditions of their lease agreements with a 30-day written notice unless otherwise specified. In a closed-end lease the leasing company takes on the risk of any additional depreciation.

The lessee is responsible for paying any difference between the estimated lease-end value residual and the actual market value at the end of the lease agreement. Open-ended leasing is typically used in commercial leasing.

Should You Choose An Open End Or A Closed End Car Lease Credit Finance

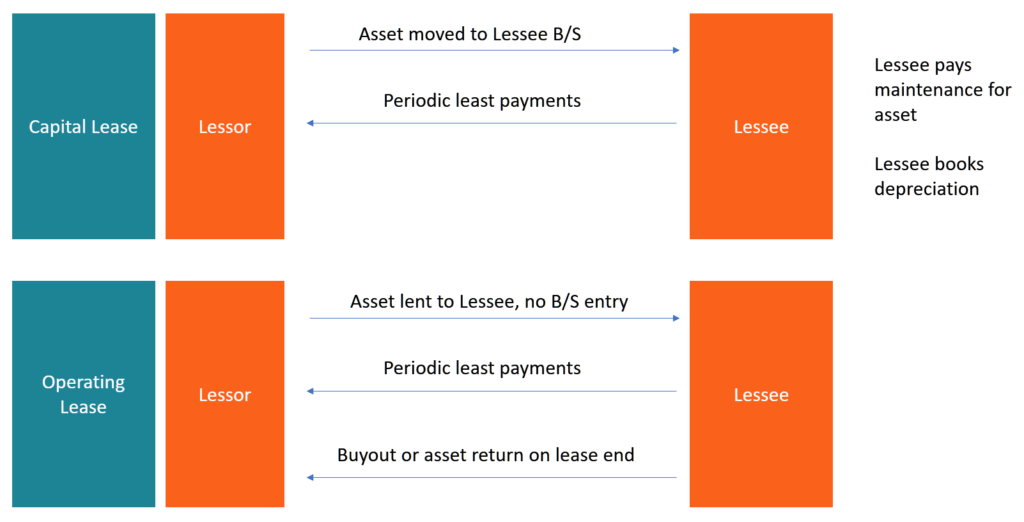

Operating Lease Learn How To Account For Operating Leases

Insuring A Leased Vehicle Bankrate

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

What Is The Difference Between An Open Vs Closed Lease

What Is The Difference Between An Open Vs Closed Lease

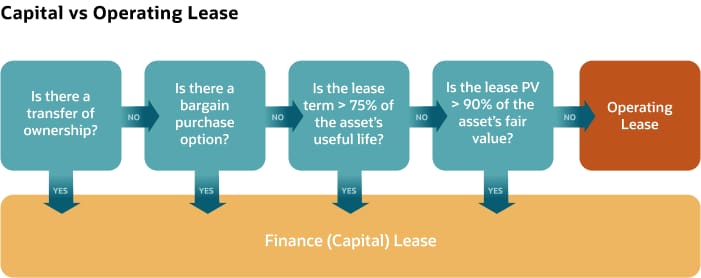

Capital Lease Vs Operating Lease What You Need To Know

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

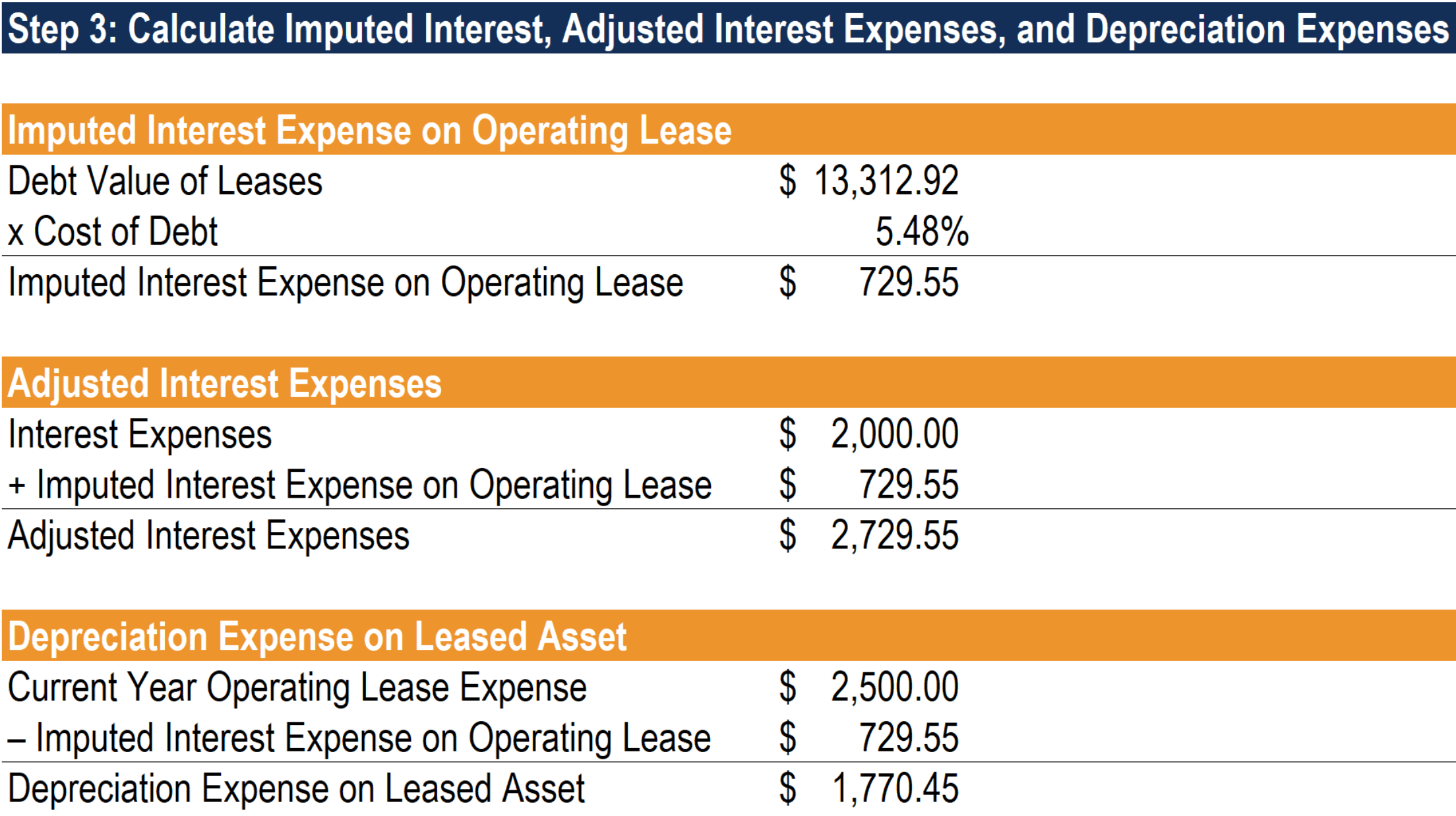

Lease Accounting Calculations And Changes Netsuite

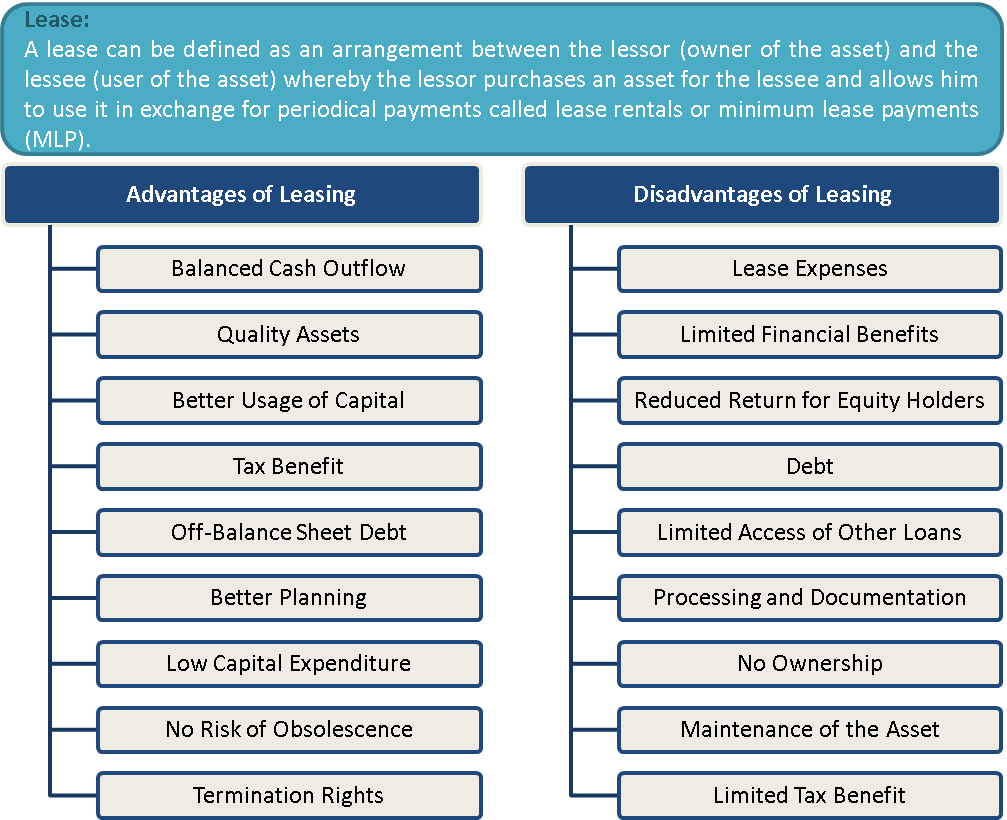

What Is Leasing Advantages And Disadvantages Efinancemanagement

Lease Vs Rent Agreement Top 8 Differences You Must Know

Hsbc Mutual Fund Launches Hsbc Mid Cap Fund In 2021 Smart Money Growing Wealth Asset Management

What Is The Difference Between An Open Vs Closed Lease

Open Vs Closed End Leases What To Know Credit Karma

Lease Accounting Calculations And Changes Netsuite

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)