last day to pay mississippi state taxes

If a taxpayer has at least 75 dollars in taxes owed the Mississippi DOR will allow taxpayers to request an Installment Agreement. Like the Federal Income Tax.

Mississippi Tax Cuts Battle 5 Things To Know

For taxpayers who filed their state returns by Sept.

. You CAN NOT request it to be mailed elsewhere. The last of those tax. An installment agreement will require the taxpayer to file all.

Pay by credit card or e-check. Mississippi Income Taxes are not. Mississippi state taxes are due annually on April 15 Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Mississippi Tax QuickPay Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. People who owe money on their 2021 property and land taxes have until Monday Feb. Single filers can claim a deduction of 2300 while married taxpayers can receive 4600.

19 with plans to send out 250000 each weekday. The Centennial State allows taxpayers to pay their taxes semi annually if their tax bill exceeds 25. To make payments without a penalty.

An LLC in the state of Mississippi has to pay two types of taxes to the Mississippi Department of Revenue. Under Mississippi law most people get a two-year redemption period after the sale. How Long Is the Redemption Period After a Mississippi Tax Sale.

1 at 5 pm. In the past lawmakers have used the excuse that there was not enough state revenue to fully fund MAEP all the while passing about 50 tax cuts. Register with the federal and state governments to file payroll taxes.

February 1 2024. 5 most rebates started going out Sept. If you pay your taxes in.

All other income tax returns. All Mississippi state taxes must be paid on the due date which is generally quarterly to the. LLC Taxes to be Paid in Mississippi.

You can use this service to quickly and securely pay your Mississippi taxes using a. All ad valorem taxes are collected by the local county andor municipal tax collectors. Residents can take advantage of the deductions and exemptions the state offers.

Mississippi tax year starts from July 01 the year before to June 30 the current year. Even if you cant get your taxes completed on time and you decide to file an. How to Make a Credit Card Payment.

Doris Spidle Tax Collector. Over the course of the program. There is an additional convenience fee to pay through the msgov portal.

Mississippi allows you to use the same itemized deductions for state income tax purposes as you use for federal income tax purposes with one exception. If you dont pay your property taxes on time youll. If you owe taxes the last day you have to pay what you owe is Wednesday April 15 2015.

If your tag is renewed online it will be mailed to the address on your registration record. So the tax year 2022 will start from July 01 2021 to June 30 2022. Last day to pay your 2023 property taxes What happens if you dont pay Mississippi property taxes.

Ad valorem taxes are payable on or before February 1 following the year of assessment. Penalties following the Feb. The due date for a single payment is April 30.

If you are receiving a refund.

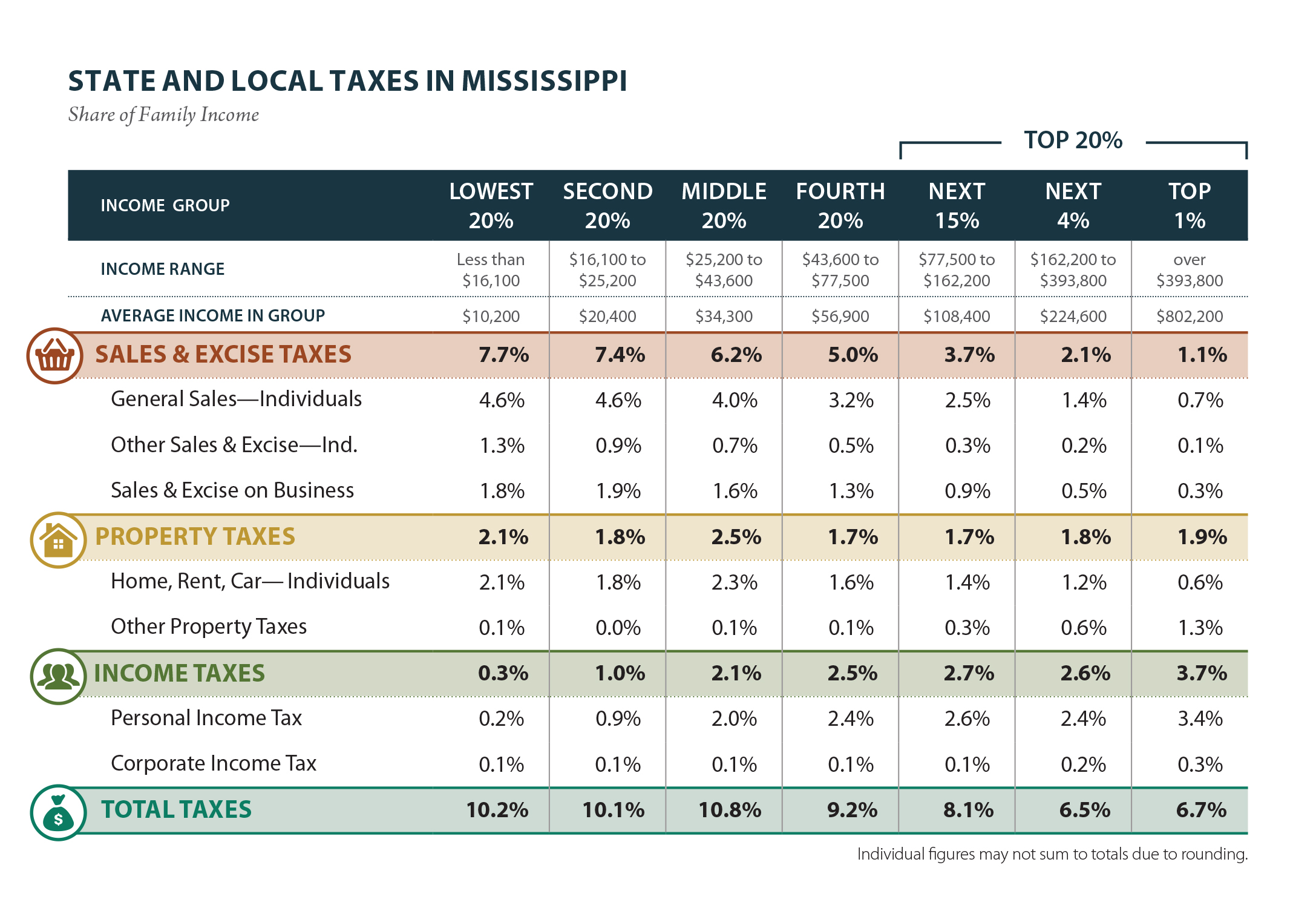

Mississippi Who Pays 6th Edition Itep

Overview Of Options For Taxpayers With Mississippi State Back Taxes

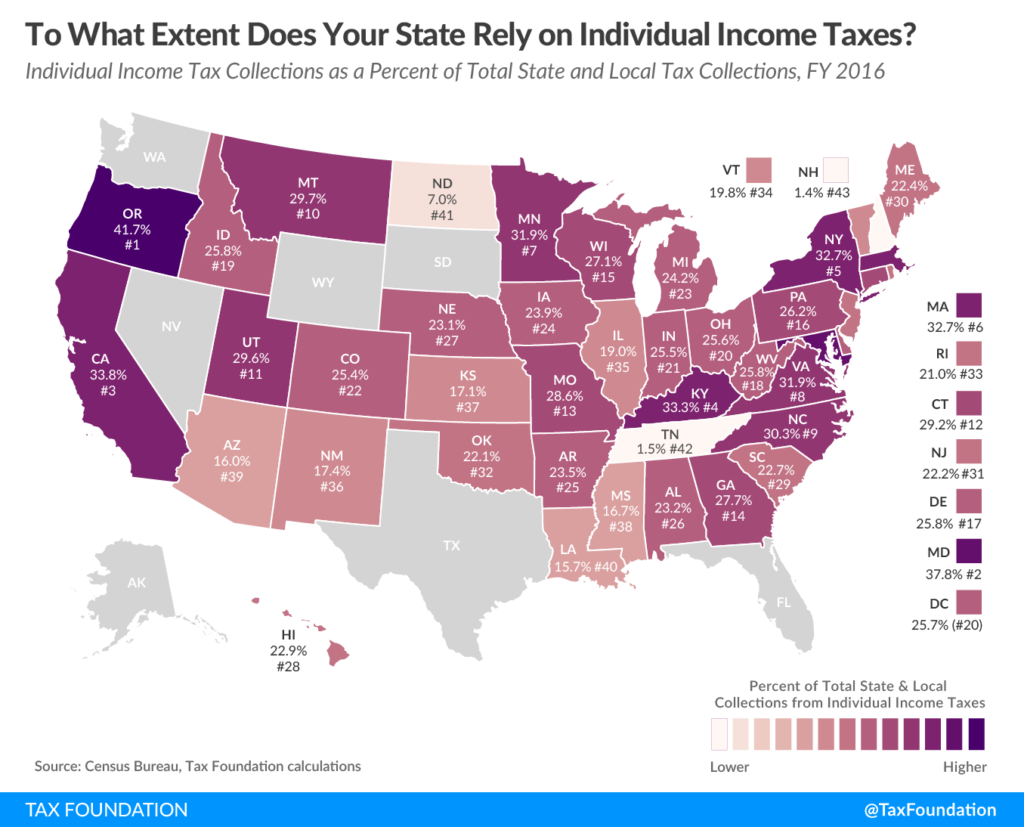

A Look At Mississippi S Reliance On Individual Income Taxes Mississippi Center For Public Policy

/cloudfront-us-east-1.images.arcpublishing.com/gray/IDD5UCLARNFVTIMPZH2OIIRWLA.PNG)

Senate Advances Historic Tax Cut Bill To Mississippi Governor S Desk

Mississippi New Laws Tax Cut Teacher Pay Raise State Song Breezynews Com Kosciusko News 24 7

Mississippi Extends Income Tax Filing Deadline For 2020

Another Day Another Tax Cut Proposal In Mississippi Legislature The Columbian Progress

Filing Mississippi State Tax Returns Things To Know Credit Karma

Mississippi Lawmakers Pass The Largest Tax Cut In State History

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Mississippi Dept Of Revenue Extends Tax Deadline Wjtv

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Frequently Asked Questions Mississippi Board Of Tax Appeals

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi State Tax Updates Withum

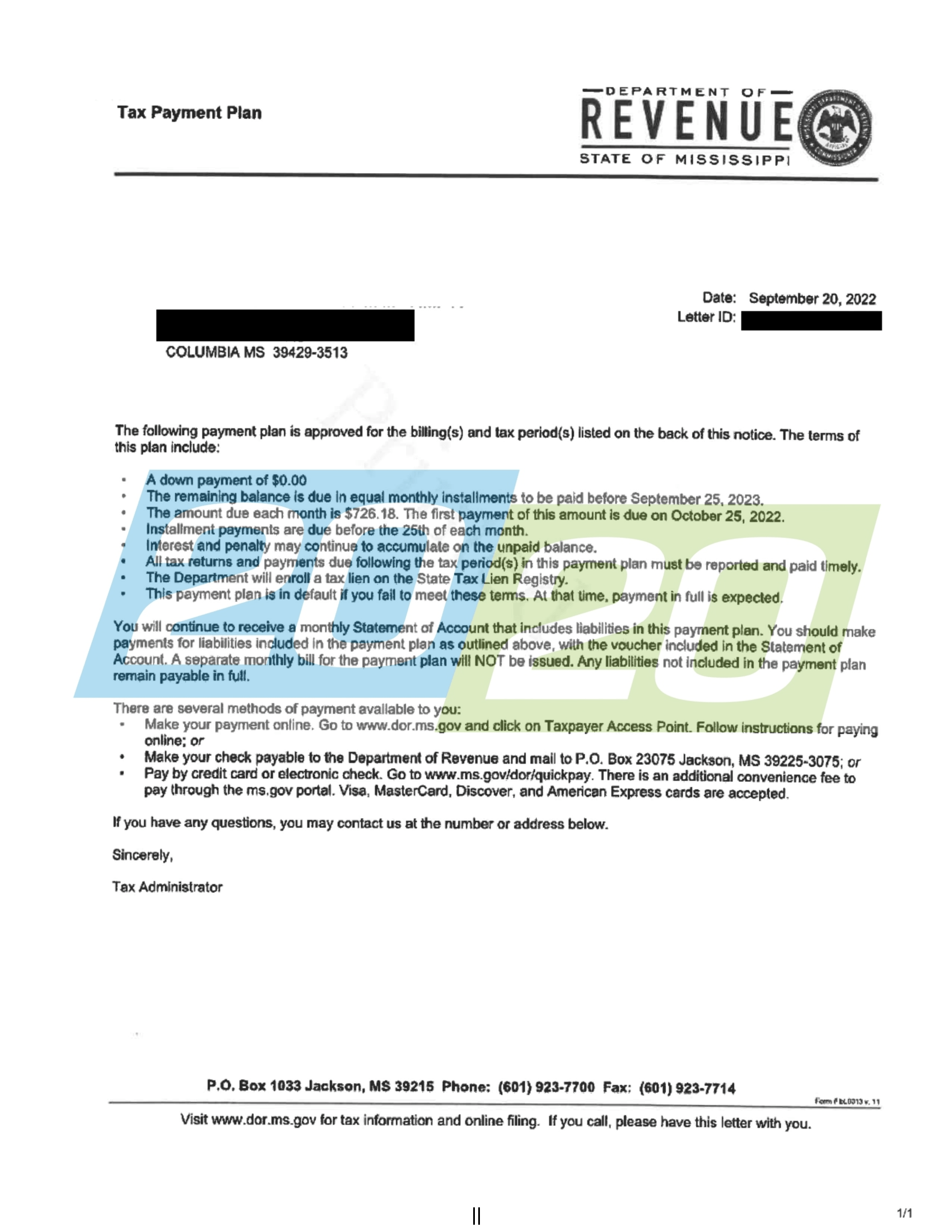

State Accepts Payment Plan In Columbia Ms 20 20 Tax Resolution

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep